FBTC Stock Review and Key Features

The increasing Bitcoin adoption creates an increasing demand for easy investment solutions. One such solution is the stock asset from the Fidelity Wise Origin Bitcoin Fund (FBTC). The Senay team is going to explain the mechanism behind the FBTC stock as a financial instrument for crypto investors like those digital assets that we always pick for our reviews, guides, and news.

FBTC is an Exchange-Traded Fund that gives access to the financial stock market supported by Bitcoin crypto without manual Bitcoin management or ownership. What is the difference between EFT and traditional brokerage accounts?

Traditional brokerage accounts let investors track Bitcoin prices through exchange-traded funds without giving recommendations about holding or selling Bitcoin as a portfolio asset.

Any spot Bitcoin ETF like FBTC operates through the market’s price-tracking function of holding Bitcoin within its reserve. Spot Bitcoin ETFs track the actual Bitcoin price while futures-based Bitcoin ETFs derive their value from future price predictions through contracts. Investors in a spot ETF gain exposure to Bitcoin’s market performance, but without the common difficulties that usually happen when you trade crypto assets “traditionally” – wallet management, private key security, and direct ownership.

Key Functions of FBTC:

- FBTC works with an expense ratio of 0.25% that stands as competitive against other Bitcoin investment vehicles;

- FBTC uses the most advanced security measures for protecting all the held funds under the full insurance coverage. They keep most digital assets in both “cold” and “hot” wallets for secure storage and liquid management;

- Volatility of the fund’s assets is estimated daily and investors always have full access to their financial accounts. Investors can withdraw all the funds from their account within 1 day, without limits;

- FBTC is a licensed ETF traded on the Cboe BZX Exchange under the FBTC ticker symbol while its exchange listing grants oversight from financial regulators just like with any other conventional financial instruments;

- Fidelity takes complete ownership of its Bitcoin assets through Fidelity Digital Asset Services LLC. This company operates independently from outsourced custody management services. Self-custody provided by Fidelity Digital Asset Services LLC brings a risk management benefit because the institution centralizes custody responsibility instead of scattering it among various entities;

- The Fidelity Bitcoin Fund allows investors to acquire FBTC through traditional investment accounts such as brokerage accounts, trust funds, etc.;

Summing up, FBTC stands as a spot Bitcoin ETF – meaning the fund handles and trades Bitcoin as physical stock assets in terms of its fund’s amount by tracking the Bitcoin market movements and responding to it.

Spot Bitcoin ETFs vs Futures Bitcoin ETFs

The main distinction between spot Bitcoin ETFs and futures Bitcoin ETFs is of how they are connected to tracking the Bitcoin’s value.

Spot Bitcoin Exchange Traded Funds own Bitcoin directly while Futures Bitcoin Exchange Traded Funds depend on the price specifications of Bitcoin’s future value.

Investors who are looking for immediate Bitcoin spot price tracking typically choose Spot ETFs like trading FBTC stocks. Those investors who want to hold their assets longer pick more predictable but less profitable Futures ETFs.

A VWMP method used by Fidelity enables the processing of exchange data to maintain accurate real-time Bitcoin prices. FBTC uses this index to track Bitcoin’s value and FBTC stock in USD transparently providing investors with a clear picture of their Bitcoin portfolios.

We also recommend you read the article by CNBC that explains the prospects and risks of investing in ETFs in 2025 and beyond.

Benefits of Investing In FBTC Stock as a Digital Asset:

- Regulated Bitcoin investment through an easy-to-use solution that bypasses complex wallet management and private key protection;

- Secured storage options and the ability to track the asset price with increased accuracy;

- Traditional brokerage account owners can use FBTC stocks as the simplest path to Bitcoin investment through the Fidelity Investments platform with regulatory compliance and trust in its management;

- You can get the FBTC exchange ticket through Cboe BZX Exchange market listings;

- The FBTC is regulated by the Fidelity Digital company and manages about $5.5 trillion in various financial assets at the time of writing;

As an innovative financial company, Fidelity offers various investment options including mutual funds and ETFs in addition to retirement accounts. Fidelity entered the Bitcoin market because the company considers crypto assets as an evolution of traditional investments. Fidelity Digital Assets maintains control of Bitcoin assets that FBTC holds through its role as a digital asset custody and trade execution service provider. They provide services for individual investors and financial organizations that want to invest in Bitcoin and other crypto assets.

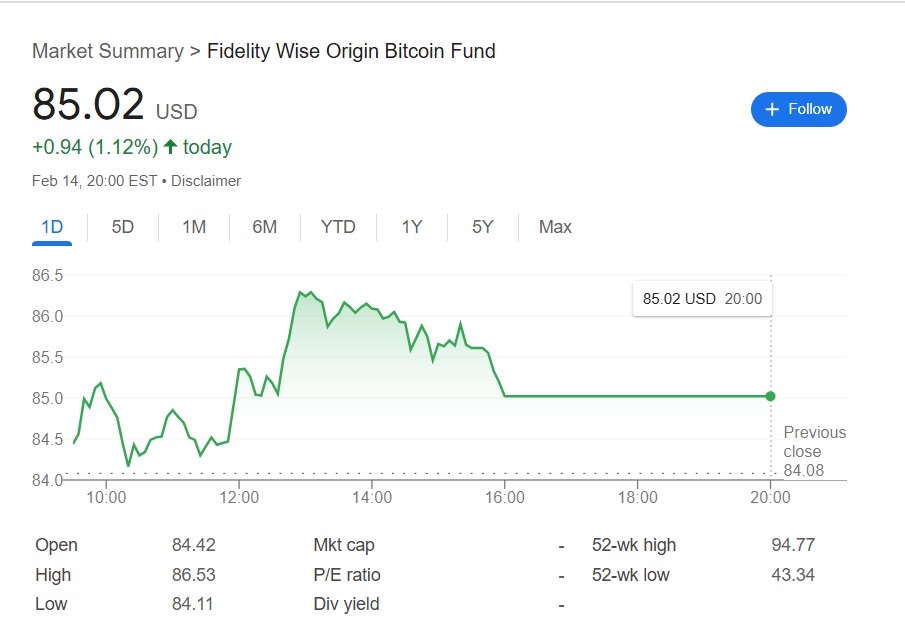

FBTC Stock Chart (As of February 15, 2025)

As of February 14, 2025, the most recent and relevant FBTC stock price was $85.02, reflecting a 1.12% increase from the previous rate. The ETF has experienced significant volatility, with a 52-week range of $43.34 to $94.81. The market capitalization of FBTC stands at approximately $21.76 billion. It means investors are very interested and confident in the fund.

You can trace the FBTC stock price today by visiting the official website of Fidelity or just using Google since this fund is licensed and regulated.

How to Invest in FBTC Stock?

Anyone can buy or sell FBTC stocks by using their brokerage account on most traditional brokerage platforms:

1) Open a Brokerage Account

You should first open a brokerage account that grants you access to trade at Cboe BZX Exchange or NYSE Arca to buy FBTC stocks. Alternatively, you may run the accounts at the Fidelity official platform or Robinhood.

2) Meet the Requirements

Check whether your broker imposes minimum account balance rules and verify the possible fees within their platform. The agreement with your broker might demand you to accept designated investment terms. The Fidelity platform implements two requirements that investors must fulfill before investing in the Designated Investments Agreement (DIA) and choosing “Most Aggressive” as their major investment goal.

3) Fund Your Brokerage Account

You must deposit money into your new brokerage account through available payment methods like linking bank accounts, adding debit cards, or bank wire transfers.

4) Search for FBTC ETF

Look for “Fidelity Wise Origin Bitcoin Fund” by using the search option available on your brokerage platform and verify its symbol/ticker matches “FBTC”. Start the purchase of FBTC shares through the buying order process. Define which number of funds you wish to invest, then decide between the markets and limit orders that correspond to your trading approach. Confirm and execute the trade.

5) Monitor Your Investment

You should track the performance of FBTC shares after buying these stocks because the Bitcoin price is highly volatile. Watch both market conditions and news that affect cryptocurrency markets. Most brokers allow users to monitor the value of ETFs by setting customized price alerts and notification systems.

Important notice! Learn about the tax regulations and rates that come along with the investment in FBTC stocks.

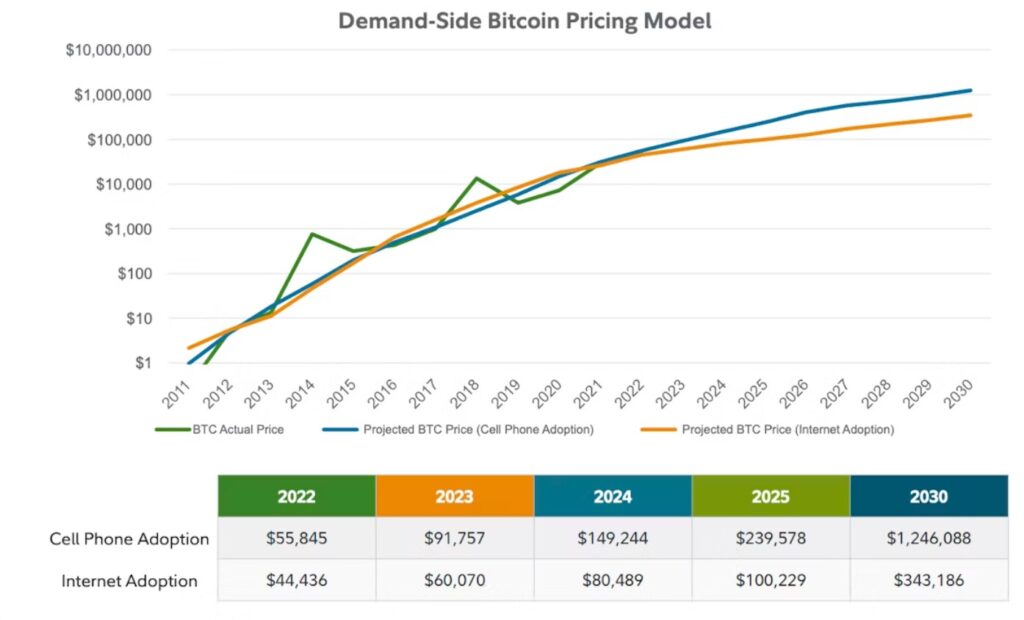

FBTC Stock Forecast for 2025-2030

Some huge analytics and smaller bloggers on YouTube share their FBTC stock price predictions for 2025 and beyond. We recommend taking all these forecasts with a grain of salt since the cryptocurrency market is very volatile and even ETFs are prone to this level of volatility.

Below we’ve gathered some forecasts for FBTC stock price based on public sources and our thoughts. It is up to you whether to trust these forecasts or not!

2025 Forecast

Many experts forecast FBTC stock to trade at an average cost of $93 in 2025 while its expected maximum value amounts to $118 and potential minimum value zones to $68. The price projections show a continuous upward trend during the year so that the value may approach $100 in April and then move up to $105 in August. The expected FBTC stock price is $107 by December 2025.

2026 Forecast

The average projection for FBTC price in 2026 stands at $132 while the maximum value may reach $160, with the expected minimum value of $104. The forthcoming price increase will amount to 49.20% above the current market value.

2027 Forecast

Some experts predict that the average FBTC stock price may reach $159 by 2027 with the maximum value projection at $192 and the minimum estimate at $127. The predicted price may rise at 80.29% above the recent market value. The expansion of Bitcoin payments around the world should boost both Bitcoin’s and FBTC’s market value.

2028 Forecast

The Bitcoin market will experience a major growth trajectory from the halving event in 2028. This event could push the Bitcoin value to $347,782. As per market estimations, the expected FBTC stock price should reach $280 as a reaction to this important event for Bitcoin investors.

2029 Forecast

By 2029 Bitcoin may surpass $400,000. That is why some analysts predict a FBTC stock will cost $330 on average during 2029. The growing popularity of Bitcoin among mainstream society will determine how well FBTC performs.

2030 Forecast

Bitcoin experts expect that Bitcoin price will hit the range from $238,150 to $610,600 by 2030. The yearly average prediction stands at $424,400. Analysts expect FBTC price to average $372 throughout 2030 based on the current market conditions – with $649.39 as the highest possible value and $367 as the lowest value. We expect the FBTC stock price predictions in 2030 to vary around the rate of $360 if the market’s trends remain as predicted.

FBTC Stock – Buy or Sell?

We’ve already covered the benefits of investing in FBTC stock. But what about the risks? Is it worth buying FBTC stocks in 2025? As usual, we post a disclaimer that this article is not financial or investment advice by any means. You have to do your research before deciding whether to invest in this asset or skip it.

Risks to consider when investing in FBTC and spot Bitcoin ETFs:

- It heavily depends on trustful Bitcoin backup management by the ETF’s custodian;

- FBTC stock prices are quite volatile since Bitcoin shows extreme price volatility across the crypto market;

- Regulations and laws related to investments in Bitcoin might cause certain challenges for all FBTC account owners;

- Fast price movements of the Bitcoin market create challenges for FBTC to maintain its intended share values because investors might purchase or sell stocks at the lowest prices;

- The competitive fees at FBTC come with certain expenses including management fees from brokers;

FBTC shows positive indications in its extended-term future outlook. Analysts project that FBTC will achieve $272.30 as the average value by 2030 at $649.39 as the highest potential while remaining at $367.68 as the minimum projection. The substantial growth of Bitcoin (despite volatile downs) and its increasing use in the “real” world hints that FBTC stocks’ value may rise.

Most Reddit users agree that FBTC stocks are good only as long-term investments due to their low interest. However, crypto assets were always considered as on-spot or short-term investment tools. Choose wisely what suits you better – ETFs are not just random memecoins (like Kendu Inu we’ve reviewed recently), the investment in such funds requires deep research and strong financial background to understand fully what you are doing.

Frequently Asked Questions

What is the future FBTC stock price prediction?

Investors anticipate the FBTC stock price up to $ 260 by 2030. The minimum value may go as low as $ 219. The potential is huge but the market is quite volatile, keep that in mind.

Does Fidelity have a Bitcoin fund?

Fidelity manages a Bitcoin fund through its Wise Origin Bitcoin Fund (FBTC).

Which is better – Ibit or FBTC?

Both Bitcoin ETFs share similar passive management features and even have identical expense ratios set at 0.25%. Most active traders favor IBIT because it offers more enhanced liquidity and tight bid-ask spread prices. FBTC is more favorable for Fidelity users who want to get self-managed Bitcoin access daily. People who require fast trading transactions and need high liquidity should choose IBIT, while FBTC offers better options for individuals who don’t like the limited access to their accounts and financial portfolios.

What is the primary ticker for FBTC?

The main ticker symbol for Fidelity Wise Origin Bitcoin Fund is “FBTC”. Double-check the platform where you invest in this ETF to avoid any scam situations.

Conclusion

The Senay team is going to deliver more interesting reviews of crypto assets. Make sure to bookmark our website to get more crypto-related news, guides, reviews, and price predictions. We want to create a trustworthy space for all crypto enthusiasts, so we would like you to help us!