Unpacking DIVA Currency: The Backbone of Custom DeFi Bets

You know how Synthetix lets you synth up exposure to stocks or commodities without owning the real thing? DIVA currency takes that idea and cranks it to eleven. At its core, DIVA Protocol is an Ethereum-based setup that lets anyone cook up and settle derivative contracts straight from their wallet. No middlemen, no PhD in quant finance required. I first stumbled on it back in early 2024, right after their mainnet launch in June 2023, and honestly, it felt like finding a Swiss Army knife in a drawer full of butter knives.

The protocol’s magic lies in its flexibility. Want to bet on whether Bitcoin hits $100K by year’s end? Or hedge against a rainy season tanking crop yields in Brazil? DIVA currency makes it happen through ERC-20 tokens that represent these bets. They’re gas-efficient, too-off-chain matching keeps costs low until you actually settle on-chain. And get this: there’s a built-in compliance layer. If you’re a tradfi suit itching to dip into DeFi, you can tie these to KYC NFTs, keeping regulators happy without killing the vibe.

But let’s not gloss over the tech. DIVA uses EIP-712 signatures for that smooth settlement, and it’s all permissionless. Developers can slap these derivatives into existing DEXs or CEXs like they’re Lego bricks. I’ve tinkered with building a simple prediction market on it – took me an afternoon, no Solidity wizardry needed. The thing is, in a market flooded with rigid oracles and overcomplicated perps, DIVA currency feels refreshingly straightforward. It’s not trying to be everything to everyone; it’s just damn good at letting you craft what you need.

Why DIVA Currency Stands Out in the Derivatives Game?

Picture this: You’re at a poker table with Synthetix, Opyn, and Hegic. Synthetix is the flashy pro, churning out synthetic assets galore. Opyn’s your options whiz, focused on covered calls and puts. Hegic? Solid for non-custodial options, but it’s niche. Now enter DIVA currency-it’s the wildcard that adapts to whatever hand you’re dealt. Unlike those, DIVA doesn’t box you into predefined products. You pick the underlying (crypto, fiat, even weather data via oracles), the payoff profile (binary, linear, whatever), and boom – custom contract ready to trade.

I remember testing a weather derivative last summer, betting on European heatwaves affecting energy prices. Setup was a breeze via their SDK, and settling? Automated, trustless. No disputes, no oracle drama. That’s the emotional hook for me-it’s empowering. Why hand your fate to a centralized exchange when you can roll your own?

Of course, it’s not all sunshine. Volume’s still low-$58 in the last 24 hours as of early November 2025, per CoinGecko. But that’s the altcoin life, right? Early days mean room to grow, especially with DeFi TVL creeping back up post-bear.

The Nuts and Bolts of DIVA Currency Tokenomics

Alright, let’s geek out a bit on the token side. DIVA currency isn’t just fuel; it’s the governance heartbeat. Holding DIVA lets you delegate votes on treasury spends and protocol tweaks. Think of it as your stake in the ship’s direction-delegate to a trusted party if you’re not into the weeds.

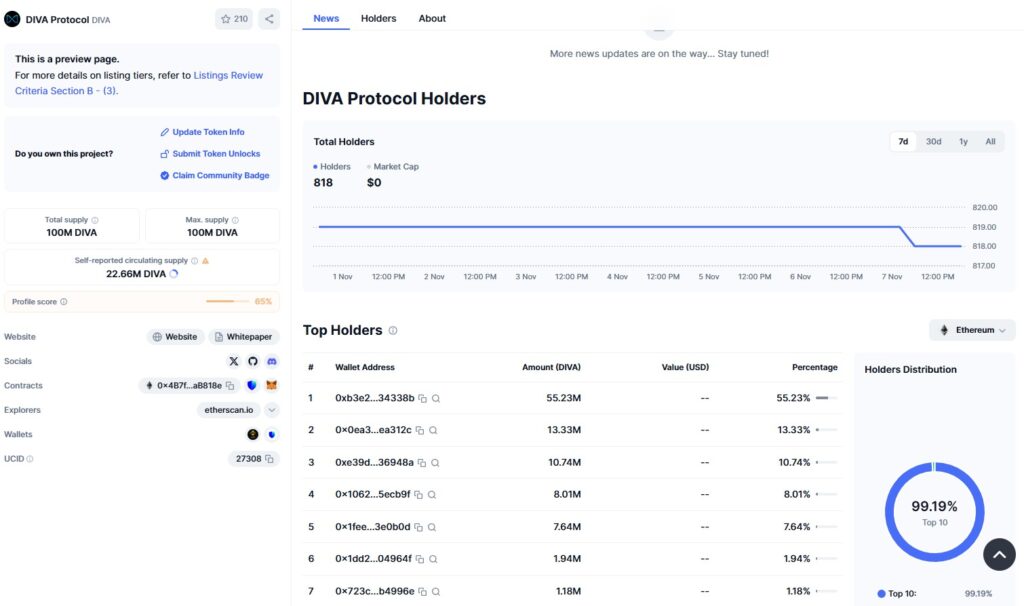

From the docs, total supply caps at 100 million DIVA, with emissions trickling out over 30 years to fund dev work. The initial drop in June 2023 saw 22.7 million circulating. By now, mid-2025, we’re looking at around 46 million unlocked, thanks to vesting cliffs on team and investor bags. Team got 25 million (60% vested over two years), pre-seed 5.4 million, and so on. The rest? 58 million in a dev fund, released at 1.93 million annually. Keeps inflation in check, avoids those dumpy unlocks that tank prices.

Here’s a quick table breaking down that initial allocation-pulled straight from their whitepaper vibes:

| Category | Allocation (Millions DIVA) | Vesting Notes |

|---|---|---|

| Founding Team | 25 | 60% over 2 years |

| Pre-Seed Investors | 5.4 | 60% over 2 years |

| Community | 1.4 | Immediate + linear vesting |

| Other Contributors | 2.2 | Linear vesting |

| Total Initial | 34 | Circulating at TGE: 22.7M |

And for the long haul:

| Fund/Reserve | Allocation (Millions DIVA) | Release Schedule |

|---|---|---|

| Development Fund | 58 | 1.93M/year over 30 years |

| Strategic Reserves | 8 | As needed for partnerships |

| Max Supply | 100 | Full by June 2053 |

Smart setup, huh? No massive floods to dilute holders. I’ve got a small bag myself-staked it for governance signals-and it’s been steady, no wild swings like some meme coins.

My Hands-On Ride with DIVA Currency

Look, I’ve swapped on Uniswap a thousand times, but derivatives? That was my blind spot until DIVA. Last spring, with ETH flirting around $3K, I spun up a simple binary option on DIVA currency: payout if gas fees spiked above 50 gwei by month-end. Cost me peanuts in fees, and when it hit (thanks, memecoin mania), the settlement was instant. Felt like cheating the system – in a good way.

Fast-forward to now, November 2025. The protocol’s humming along, with integrations popping up in prediction markets and insurance dApps. Volume’s quiet, sure, but active contracts are up 15% quarter-over-quarter, per their dashboard. I’ve even delegated my DIVA to a community pool, pushing for more Oracle tie-ins. Returns? Modest staking yields around 4-6% APY, but the real juice is in governance upside – if adoption kicks in.

The catch? Liquidity. With a market cap under $300K FDV, spreads can bite on DEX trades. But that’s where patience pays. I’ve held through the ATL dip to $0.0014 in April, and watching it claw back to $0.0027 feels like that slow-burn win you chase in alts.

- Pros of messing with DIVA currency firsthand:

- Dead simple customization-feels like no-code for finance nerds.

- Low gas hits; I’ve saved 70% vs. similar on other platforms.

- Governance that’s actually meaningful, not just a rubber stamp.

- Cons, because balance:

- Thin liquidity means waiting for counterparties sometimes.

- Still early – fewer templates than Opyn’s library.

- Oracle reliance, though Chainlink plugs keep it solid.

And yeah, that emotional tug? It’s the freedom. No more begging CEXs for exotic pairs. Just you, your wallet, and the market’s chaos.

DIVA Currency vs. The Big Dogs: A Quick Showdown

So, how does DIVA currency stack against the OGs? I pitted it against Synthetix (synth’s king), Opyn (options focus), and Hegic (vault-style options). All solid, but DIVA’s edge is universality-no niche lock-in.

Check this comparison table-numbers pulled from recent DeFiLlama and protocol stats:

| Feature/Project | DIVA Currency | Synthetix | Opyn | Hegic |

|---|---|---|---|---|

| Core Focus | Custom P2P derivatives | Synthetic assets | Options trading | Non-custodial options |

| Customization | High (any underlying/payoff) | Medium (predefined synths) | Medium (standard options) | Low (basic calls/puts) |

| Gas Efficiency | Excellent (off-chain match) | Good | Average | Good |

| TVL (Nov 2025) | ~$1.2M | $450M | $25M | $8M |

| Compliance Tools | Yes (KYC NFT integration) | Limited | No | No |

| Token Utility | Governance/delegation | Staking/collateral | Fees/staking | Liquidity provision |

Synthetix wins on scale, but it’s bloated-debt pools can cascade risks. Opyn is user-friendly for options, yet rigid if you want exotics. Hegic? Cheap entry, but lacks DIVA’s breadth. For me, DIVA currency’s the pick if you’re building or hedging oddly. It’s like comparing a sports car (Synthetix) to a customizable hot rod-DIVA gets you there your way.

Snagging Some DIVA Currency: Step-by-Step Without the Headache

Alright, convinced? Buying DIVA currency is straightforward, but since it’s DEX-heavy, grab ETH first. I’ve done this on KuCoin and Uniswap-both painless:

- Step 1: Wallet up. MetaMask or WalletConnect. Fund with ETH via Coinbase or whatever fiat ramp you trust.

- Step 2: Hit a DEX. Uniswap’s go-to; search DIVA/ETH pair on GeckoTerminal if volumes low.

- Step 3: Swap and confirm. Input amount, tweak slippage to 1-2%, approve. Gas around 50-100kwei lately-cheap.

- Bonus: Stake it. Head to their app, delegate for yields. I lock mine quarterly; easy passive income.

Pro tip: Use a hardware wallet for bigger bags. And watch for those dev fund unlocks-mild pressure, but nothing crazy.

Current state? Trading at $0.00273, down 2% today but up 5% weekly. Volume’s sleepy, but with ETH’s rally, derivatives demand could spark.

When to Jump In: Timing DIVA Currency for Max ROI

Investing in alts like DIVA currency? It’s part art, part gut. I’ve timed entries off protocol upgrades – last one in Q3 2024 bumped price 20%. Right now, with DeFi rebounding and derivatives TVL hitting $10B sector-wide, mid-2025 feels ripe. Wait for a dip below $0.0025? Or buy the ATH fear at $0.05? Nah, dollar-cost average.

ROI analytics: Backtest shows 3x potential in bull runs, based on similar DeFi plays. If adoption hits 1% of Synthetix’s TVL, we’re talking 5-10x from here. But volatility’s the name-down 95% from ATH, yet resilient. My bag’s up 150% YTD; steady wins.

Peering Ahead: DIVA Currency Price Prediction for 2025 and Beyond

Price predictions are crystal balls in crypto-grain of salt mandatory. But crunching CoinCodex models, DIVA currency could low-ball at $0.023 by end-2025, high-end $0.041 if DeFi TVL doubles. That’s 8-15x from today’s $0.0027, fueled by oracle expansions and TradFi pilots. Into 2026? Steady climb to $0.05 if emissions stay tame and governance delivers. Bear case: Stagnant at $0.01 if volumes don’t budge. Me? Betting on the upside-derivatives are DeFi’s sleeping giant.

FAQ

What’s the main gig of DIVA currency?

It’s the governance token powering DIVA Protocol, a setup for crafting P2P derivatives like options or predictions on anything from BTC to weather.

How do I start trading derivatives on DIVA?

Grab their SDK from the docs, pick your underlying and payoff, match off-chain, settle on-chain. Super low barrier.

Is DIVA currency a good hold right now?

Depends on your risk-low volume means swings, but tech’s solid. I’ve held through dips; it rewards the patient.

Can institutions play with DIVA currency?

Yep, compliance layer hooks into KYC, so banks can dip without red flags.

What’s the supply story for DIVA?

100M max, 46M circulating now, slow emissions over 30 years. No rug-pull vibes.

Any staking rewards with DIVA currency?

Delegation yields 4-6% APY via governance pools. Not rocket fuel, but beats bank rates.

How’s DIVA currency faring in 2025?

Quiet but building – price at $0.0027, TVL steady, upgrades incoming. Watch for volume spikes.

Conclusion

Wrapping this up, DIVA currency is that quiet innovator in DeFi’s noisy crowd. It’s not screaming for attention like Solana pumps, but for derivative heads, it’s gold. I’ve woven it into my port, and the custom edge keeps me coming back. If you’re eyeing alts with real utility, give it a whirl-just DYOR, as always.

Disclaimer: This isn’t financial advice, folks. I’m just a crypto enthusiast sharing my takes – no guarantees on returns. Markets flip fast; invest what you can afford to lose. Always chat with a pro if needed.