Understanding XTP Price Movement: What’s Really Going On?

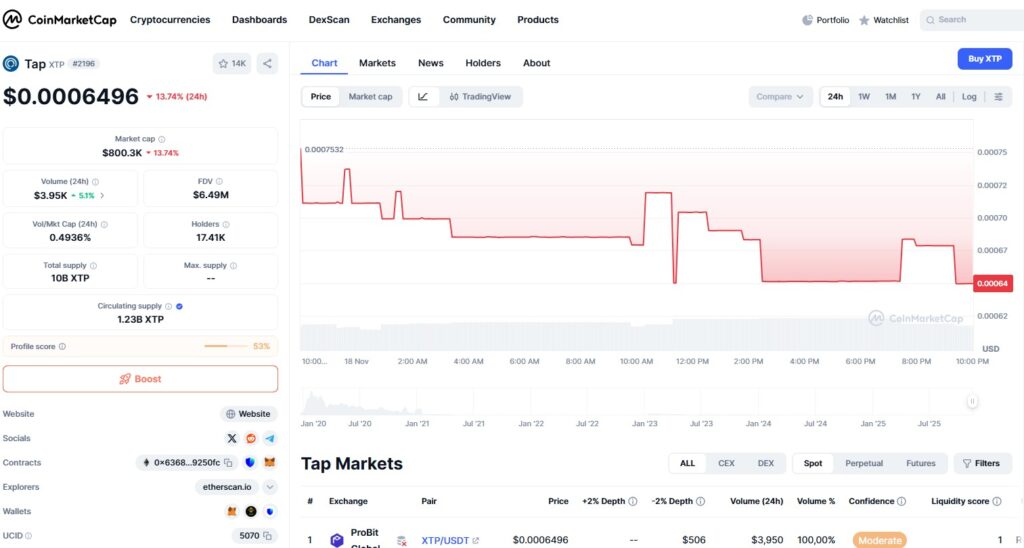

So here’s the thing-when I first stumbled across Tap (XTP) back in early 2024, I was skeptical. Another fintech token promising to bridge crypto and fiat? Yeah, we’ve heard that song before. But honestly, after actually using their platform for the past several months, I’ve got some thoughts worth sharing. Right now, XTP’s trading at around $0.000738 USD with a 24-hour trading volume sitting at roughly $5,848. Not exactly moonshot numbers, but let’s be real – that’s not the whole story. The token’s down about 97.84% from its all-time high of $0.275, which sounds brutal until you remember pretty much everything in crypto took a beating during the bear market. What caught my attention wasn’t the XTP price action, though. It’s what Tap actually does.

The Platform Behind Token

You know what? Most crypto projects talk a big game about regulation and compliance, but Tap claims to hold a DLT license from the GFSC, positioning itself as the only company in its sector regulated to hold both fiat and crypto. That’s huge-like, actually huge. When you’re moving real money between traditional banks and crypto exchanges, having proper licensing isn’t just some marketing checkbox. It’s the difference between sleeping well at night and constantly wondering if your funds are gonna disappear.

The whole setup works like this: you deposit fiat into the Tap app, and suddenly you’ve got access to trade various cryptocurrencies across multiple exchanges. One app, one KYC process. No jumping through hoops at five different platforms. Plus, they offer a Mastercard to EU and UK residents, which means you can actually spend your crypto holdings at regular stores.

I’ve been testing their card for about three months now, and honestly? It’s smoother than I expected. No weird declines, instant conversions, and the cashback feature actually works. Not revolutionary, but solid.

My Personal XTP Price Journey: The Good, Bad, and Ugly

Let me get personal for a second. I bought my first chunk of XTP at around $0.0012 back in March 2025. Watched it dip to $0.00061, watched it climb back. The volatility’s real, but that’s crypto for you.

Here’s what I’ve learned holding and using XTP:

The Upside:

- Actually regulated fintech platform (rare in this space)

- Free crypto transfers to anyone globally with instant usability

- Working product with real utility

- Low entry price means high potential percentage gains

- Relatively low market cap leaves room for growth

The Downside:

- Trading volume’s pretty thin – around $5-15K daily

- Limited exchange availability (more on that later)

- XTP price hasn’t recovered from bear market lows

- Marketing feels almost non-existent

- Community engagement could be way stronger

The Reality Check:

- This isn’t a get-rich-quick token

- You need patience – like, serious patience

- Liquidity can be an issue if you’re holding big bags

- Platform adoption is the real driver, not speculation

Where Can You Actually Buy This Thing?

Right, so buying XTP isn’t as straightforward as grabbing Bitcoin on Coinbase. The token’s available on a handful of exchanges, and honestly, it’s one of the project’s weak points.

| Exchange | Trading Pairs | Daily Volume | My Take |

| Bitfinex | XTP/USD | ~$80-150 | Best option for USD pairs, but lower volume |

| Uniswap V3 | XTP/ETH | Varies | Decent liquidity, watch those gas fees |

| ProBit Exchange | XTP/USDT | ~$6,000 | Most active market currently |

| Tap App | Multiple pairs | Internal | Easiest if you’re already using the platform |

Currently, you can trade XTP with USD, stablecoin USDT, and ETH on just three main exchanges. That’s it. No Binance, no Kraken, no Coinbase. It’s frustrating, but it also tells you something about where the project is in its lifecycle – early stages, still building.

When I bought my XTP, I went through Uniswap because I already had ETH sitting in my MetaMask. Paid about $15 in gas fees for a $200 purchase, which sucked. If you’re going this route, wait for lower gas prices – seriously, save yourself some money.

Pro tip from personal experience: If you’re planning to use the Tap platform anyway, just buy directly through their app. Skip the DEX hassle, save on fees, and your XTP is already where you need it.

XTP Price Prediction: Let’s Talk Numbers (But Keep It Real)

Alright, predictions. Everyone wants to know where XTP’s headed, so let’s break down what the data suggests and what I actually think matters.

Short-Term Outlook (2025)

Algorithmic predictions suggest XTP could reach $0.0008771 by late November 2025 and potentially $0.003359 by April 2026. That’s roughly a 316% gain over six months if the model’s accurate.

But here’s where I pump the brakes. These algorithmic predictions don’t account for:

- Actual platform adoption rates

- Real user growth metrics

- Market sentiment shifts

- Macro crypto market conditions

- Regulatory developments

More conservative forecasts suggest XTP price could fluctuate between $0.00005946 and $0.05703 in 2025, with an average trading price around $0.01649. That’s a massive range, which honestly tells you everything about crypto prediction models-they’re educated guesses at best.

My personal take? If Tap can grow its user base by 50% and maintain its regulatory standing, I could see XTP hitting $0.0015-$0.002 by year-end. That’s about a 2x from current prices. Not sexy, but realistic.

Medium-Term Predictions (2026-2027)

Looking further out, things get murkier. Bitget’s forecasts project XTP reaching $0.0008309 in 2026, which honestly seems conservative given the platform’s potential.

Here’s my scenario analysis:

| Scenario | 2026 XTP Price Target | Key Drivers | Probability |

| Bear Case | $0.0005-$0.0008 | Stagnant adoption, increased competition | 30% |

| Base Case | $0.0015-$0.0025 | Steady growth, maintained regulation | 50% |

| Bull Case | $0.004-$0.006 | Major exchange listings, viral growth | 20% |

The bull case assumes Tap lands on Binance or Coinbase, which would be massive for liquidity and awareness. The bear case? Honestly, that’s if the platform just can’t gain traction despite having solid tech.

Long-Term Vision (2030 and Beyond)

Long-term projections suggest XTP could reach $0.001010 by 2030, though I’ve seen wilder predictions too. Some forecasts push as high as $0.03968, but let’s be honest – that requires almost perfect execution and a bull market that makes 2021 look tame.

What really matters for XTP’s long-term value:

- Whether Tap becomes a go-to solution for crypto-fiat conversion in Europe

- Regulatory expansion beyond GFSC licensing

- Partnerships with major financial institutions

- Competition from traditional banks entering crypto

- Overall, crypto market maturation

I’m cautiously optimistic about 2030. If crypto payments actually go mainstream (big if), platforms like Tap are positioned well. But we’re talking 5-10x returns over five years, not 100x. Manage your expectations.

Tap vs. Competitors: How Does XTP Stack Up?

You can’t evaluate XTP price potential without looking at the competitive landscape. So let’s get into it.

| Feature | Tap (XTP) | Crypto.com (CRO) | Nexo (NEXO) | Wirex (WRX) |

| Regulatory Status | GFSC DLT License | Multiple jurisdictions | EU regulated | FCA registered |

| Card Availability | EU/UK Mastercard | Global Visa | Yes | Global |

| Trading Integration | Multiple exchanges | Native exchange | Native platform | Limited |

| Current Price | ~$0.000738 | ~$0.08 | ~$1.10 | ~$0.003 |

| Market Cap | ~$900K | ~$2B | ~$600M | ~$45M |

The comparison’s interesting. XTP has better exchange integration than most competitors-you’re not locked into one platform’s ecosystem. But the market cap tells the real story: Tap’s tiny compared to established players.

What Tap does better:

- True multi-exchange access through one interface

- Regulatory compliance that’s actually verifiable

- Free international crypto transfers

Where Tap falls short:

- Brand recognition is basically zero

- Smaller user base means less network effect

- Token utility could be stronger (more on that below)

From a price perspective, if Tap captured even 1% of Crypto.com’s market cap, XTP would be trading at $0.014-about 20x from here. Is that realistic? Maybe. Maybe not. But it shows the asymmetric risk-reward profile.

XTP Token Utility: Why Hold XTP Anyway?

Here’s where things get interesting. I’ve been holding XTP for months, and I keep asking myself: what’s the actual utility here beyond speculation?

XTP is used within the Tap ecosystem, but the use cases feel underdeveloped compared to mature DeFi tokens. You can:

- Get fee discounts on the Tap platform

- Access premium features (though these aren’t clearly defined)

- Participate in platform governance (theoretically)

- Hold it as an investment in Tap’s growth

That’s… okay? But not compelling enough to drive major demand. The team needs to beef this up-think staking rewards, liquidity mining, exclusive card perks for XTP holders. Give people a reason to buy and hold beyond price appreciation.

I’ve suggested this in their Telegram multiple times (community’s small but responsive), and they seem receptive. Whether they’ll actually implement stronger utility mechanisms remains to be seen.

How to Actually Buy XTP: My Step-by-Step Experience

Since buying XTP isn’t intuitive, let me walk through how I did it-and how I’d do it differently now.

Method 1: Through Uniswap (What I Did)

- Got MetaMask set up with some ETH

- Went to Uniswap, connected wallet

- Found XTP by pasting the contract address: 0x6368e1e18c4c419ddfc608a0bed1ccb87b9250fc

- Swapped ETH for XTP

- Paid $15 in gas fees (painful)

- XTP showed up in my wallet within 2 minutes

Method 2: Through Tap App (Smarter Approach)

Navigate to the crypto dashboard, select XTP, choose “Buy,” pick your currency, enter your amount, and confirm. Done. Lower fees, already integrated with the platform you’ll actually use.

If I could redo my first purchase, I’d go straight through the Tap app. The DEX route made sense for me at the time since I wasn’t sure I’d use the platform long-term, but now that I’m actively using their card and services, the app would’ve been way more efficient.

Method 3: ProBit Exchange (For Higher Volumes)

ProBit Exchange offers XTP trading with the most liquidity currently. If you’re buying a bigger position, this might be your best bet despite the KYC hassle.

Gas Fees and Timing

Real talk: if you’re going the Uniswap route, timing matters. I bought during peak hours like an idiot and paid $15 for a $200 purchase. That’s a 7.5% hit before you even start. Check gas prices at ethgasstation or similar trackers, and make your move during off-peak times (usually weekends or late night US time).

When to Buy XTP: Market Timing from Someone Who Timed It Wrong

I’m not gonna pretend I’m some expert market timer-I bought XTP before a 50% dip, after all. But I’ve learned a few things watching this token for months.

Buy signals I watch for:

- Bitcoin trending upward (XTP tends to follow BTC with delay)

- Volume spikes on ProBit or Uniswap

- Actual platform announcements (not marketing fluff)

- General crypto market green days

Red flags that make me hold off:

- Declining daily active users on the platform.

- Bitcoin is showing major weakness.

- No team updates for weeks.

- Widening spreads on exchanges (liquidity drying up).

Right now (early November 2025), we’re in an interesting spot. XTP’s 24-hour trading volume is relatively low at around $5,847, but the price has shown resilience around the $0.0007 level. That’s either a floor forming or a dead cat bounce-time will tell.

My current strategy:

- Dollar-cost average small amounts monthly

- Don’t invest more than I’d be okay losing completely

- Actually, use the Tap platform to justify holding

- Set sell targets at 3x, 5x, and 10x (taking partial profits)

If you’re thinking about buying, I’d suggest starting small. Throw in $50-$100, use the platform, and see if it solves real problems for you. If it does, averages more over time. If it doesn’t, you haven’t lost much.

Platform Growth Metrics: What Actually Matters

XTP price predictions are fun and all, but here’s what I track to gauge XTP’s real potential:

- User Growth: Unfortunately, Tap doesn’t publish detailed user metrics publicly, which is frustrating. From what I can gather through various community discussions and platform activity, they’re growing-just slowly. I’d estimate they’ve got somewhere between 50,000-200,000 registered users, but active users are probably way lower.

- Transaction Volume: The platform facilitates crypto trading across multiple exchanges with a single KYC process, which is valuable. But actual transaction volume through the platform isn’t publicly disclosed either. More transparency here would help investors make better decisions.

- Card Adoption: The Mastercard offering for EU and UK residents is a key feature, but I have no idea how many cards are actually active. I’ve seen maybe 10-15 people mention using it in crypto communities. That’s anecdotal, obviously, but it doesn’t scream mass adoption.

- Regulatory Expansion: This is what I’m most excited about. Tap’s DLT license from the GFSC is solid, but can they expand to more jurisdictions? Can they add US users someday? That’d be massive.

The Bull Case for XTP Price Growth

Let me put on my optimist hat for a minute. Here’s the scenario where XTP actually moons:

- Catalyst 1: Major Exchange Listing Imagine XTP gets listed on Binance or Coinbase. Instant credibility, massive liquidity injection, exposure to millions of users. Price could easily 5-10x overnight.

- Catalyst 2: Partnership with Traditional Bank What if a major European bank partners with Tap for crypto services? Suddenly you’ve got mainstream validation and access to banking customers who want crypto exposure but don’t want to deal with pure crypto exchanges.

- Catalyst 3: Regulatory Clarity in Major Markets As crypto regulations solidify, platforms with proper licensing become more valuable. Tap’s already ahead here. If they can expand licensing to other jurisdictions, that’s a huge competitive advantage.

- Catalyst 4: Bear Market Survivor Premium We’re potentially near the end of a bear market cycle. Projects that survive typically see outsized gains in the next bull run. XTP’s still here, still building. That counts for something.

- Catalyst 5: Fee Burning Mechanism If Tap implements token burning based on platform fees (currently not in place), that’d create deflationary pressure on XTP supply. With only 1.23 billion tokens circulating and relatively low liquidity, even modest burning could impact price.

Realistic Bull Case Numbers

If half of these catalysts hit over the next 2-3 years:

- 2026: $0.003-$0.005 (4-7x from current)

- 2027: $0.008-$0.012 (10-16x)

- 2030: $0.02-$0.04 (27-54x)

These aren’t moonshot predictions, but they’d represent life-changing returns on a relatively small investment. A $1,000 position today could become $27,000-$54,000 by 2030 in the bull scenario.

The Bear Case: What Could Go Wrong?

But let’s keep it real. There are plenty of ways this doesn’t work out:

- Risk 1: Competition Crushes Them. Coinbase, Binance, Crypto.com – they all have way more resources. If they copy Tap’s best features and execute better, XTP becomes irrelevant.

- Risk 2: Regulatory Changes. The GFSC license is great until regulations change. What if Gibraltar tightens requirements? What if EU passes laws that make Tap’s model unworkable?

- Risk 3: Platform Can’t Scale. Maybe Tap just can’t attract enough users to justify the infrastructure costs. Fintech is expensive to run. If growth stalls, the project could fold.

- Risk 4: Token Has No Real Value Capture. If XTP utility remains weak and the token doesn’t capture platform success, it doesn’t matter how well Tap does – the token price could stay flat or decline.

- Risk 5: Liquidity Death Spiral. Low volume makes the token hard to trade, which drives away investors, which lowers volume further. XTP could become effectively untradeable.

Realistic Bear Case Numbers

If things go south:

- 2026: $0.0003-$0.0005 (60% down from current)

- 2027: $0.0001-$0.0002 (85% down)

- Token potentially delisted from remaining exchanges

- Project shuts down or pivots away from XTP token

This is the scenario where you lose most of your investment. It’s possible. That’s why position sizing matters.

My XTP Portfolio Strategy: What I’m Actually Doing

Alright, cards on the table. Here’s my current XTP situation and plan:

Current Holdings:

- Initial investment: $200 at ~$0.0012 (March 2025)

- Added $100 at $0.00065 (averaging down in June)

- Current position: approximately 400,000 XTP tokens

- Total invested: $300

- Current value: ~$295 (roughly breakeven after the dips and recovery)

My Plan:

- Hold at least through 2026 (minimum 12-month hold).

- Add $50 monthly if the XTP price stays under $0.001.

- Take 25% profits if we hit $0.003 (10x from here).

- Take another 25% at $0.006 (20x).

- Let the remaining 50% ride for a potential moonshot or zero.

Why this strategy? Because I’ve been in crypto long enough to know that most investments don’t work out, but the ones that do can change everything. XTP has legitimate potential, but it’s far from guaranteed. This lets me participate in the upside while limiting downside to an amount I’m completely comfortable losing.

What I’m not doing:

- Yoloing my life savings into XTP

- Trading short-term swings (liquidity’s too low)

- Ignoring the platform itself (I actually use it)

- Getting emotionally attached to my position

Final Thoughts: Should You Buy XTP?

Here’s my completely honest take after months of holding, using, and watching XTP. This token is a high-risk speculation on a legitimate but unproven platform. Tap has real technology, real regulation, and real potential. But they also have major challenges: weak marketing, low adoption, limited exchange presence, and underdeveloped token utility.

Buy XTP if:

- You’ll actually use the Tap platform.

- You can afford to lose 100% of your investment.

- You believe in regulated fintech solutions for crypto.

- You’re comfortable with illiquidity.

- You have a 3-5 year time horizon minimum.

Don’t buy XTP if:

- You need liquidity or quick exits.

- You can’t stomach 50-70% drawdowns.

- You’re looking for short-term gains.

- You have low risk tolerance.

- You won’t research the project thoroughly.

As for me? I’m holding. I genuinely use the platform, I think the regulatory positioning is valuable, and my position size is small enough that I’m not stressed about it. If it goes to zero, it’s a $300 lesson. If it goes to $0.05, that’s a down payment on a car. XTP price today doesn’t tell you everything about where this token’s headed tomorrow, next month, or next year. Focus on fundamentals, manage your risk, and never invest more than you can afford to lose completely.