What Is StakeStone?

StakeStone stirred the crypto community. It is not just another staking platform, it offers an innovation in the Ethereum ecosystem. If you are not willing to open your node or lock up 32 ETH, imagine earning high yields from the system that can do this instead of you. That’s what the StakeStone platform offers. Thanks to its simplicity, this staking platform can be used by anyone – both newcomers and veteran investors.

In simple words, the StakeStone crypto platform serves as a bridge between stake and liquidity provisions. It lets them take part in ETH staking pools while holding full control over their assets. However, re-staking protocols are used on this platform to increase returns, making every single step of all the involved parties transparent. StakeStone also enhances staking by integrating some Layer 2 (L2) solutions to make it more efficient and cheaper.

The unique part of the StakeStone.IO platform is its focus on liquidity. Instead of tying up funds into long-term stakes, users receive $STONE, with a new approach to how ETHs are staked. These $STONE tokens are liquid i.e., you can trade them, spend them, and also lend them out as collateral through the integrated DeFi applications. This flexibility offers new opportunities, so the users could benefit from earning more but still maintain the security level.

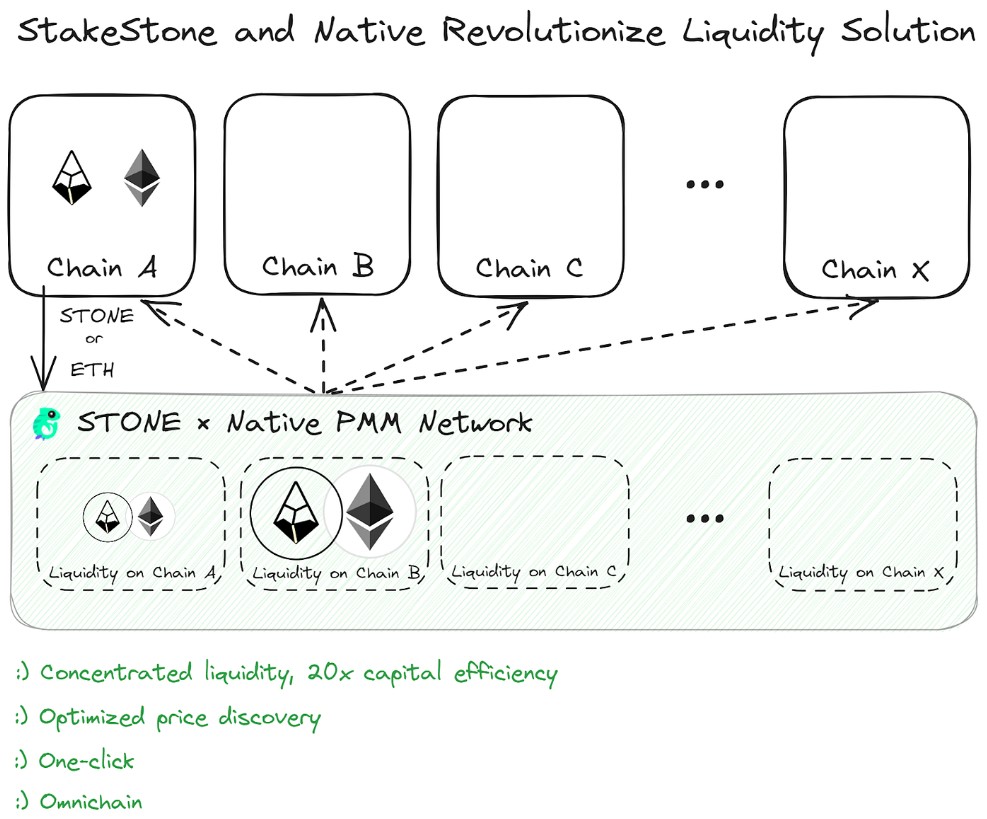

Also, the LayerZero technology underpins the core of StakeStone’s innovation. It is a cross-chain transfer of the assets and prices from one blockchain to another. It is getting easier to conduct transactions on multiple blockchains. StakeStone’s ecosystem is compatible with Ethereum, Polygon, and Arbitrum — its interoperability is seamless no matter the blockchain. You can read more about the ecosystem of StakeStone on the official website.

Whilst StakeStone is tech, StakeStone is also community. The project was founded with the vision of democratizing staking reward access, and it has been popular. The company raised $10 million for the independent StakeStone funding within 2 years and integrated the top-notch DeFi platforms. $STONE is its native token, and it serves within the bridge ecosystem to provide competitive yields and versatile uses.

StakeStone Key Features:

- Being the flexible StakeStone Ether staking platform, this project turns out to be a real game changer thanks to the combination of innovation and tipsy user-friendly features.

- Simple Ethereum staking processes – there is no need to set up your node with a limit of 32 ETH. StakeStone is a platform that takes down barriers by enabling staking for everyone;

- StakeStone offers an impressive competitive APY of ~3.43% on 336,710 through the ETH stake. Those crypto investors who want to have most of their Ethereum investment may find a StakeStone platform a smart choice;

- Security and transparency are primary features of StakeStone being the non-custodial and transparent ecosystem. Users can maintain control of their assets and be aware of what is happening with their investments;

- $STONE is a token that serves to provide the ETH staking rewards. Its holders are expected to re-staking on different blockchain ecosystems to boost liquidity and generate better yield opportunities;

- Powered with the LayerZero technology – StakeStone supports cross-chain assets and price transfers without additional bridges. Such an approach is flexible and versatile;

- Security is not compromised. It is a safe-staking environment as StakeStone has undergone the third-party audit by Secure3 & Veridise to provide a self-custodial, permissionless environment;

StakeStone – Pros and Cons

| Pros | Cons |

| User-friendly platform with simpler Ethereum staking | Investors need to have basic knowledge about staking and DeFi protocols to understand how to use |

| Non-custodial operations with full control over the staked assets | Not many details about tokenomics, especially for the upcoming months |

| Competitive annual percentage yields (APYs) | No roadmap from the team |

| Innovative liquid “staked token” system | Low influencer-marketing performance |

| Strong security measures backed by audits and advanced asset protection | Low marketing infrastructure score |

| Innovative concepts and significant utility potential | No work experience at top-tier companies among the founders |

| Many independent and unbiased security auditors approved the project | |

| Growing userbase, with over 150K+ stakers | |

| Above-average SMM and SEO scores | |

| Many partnerships with significant investments |

StakeStone – Staking Rewards and Conditions

The ETH staking structure offered by StakeStone could become a new standard for staking rewards and flexibility that is sufficient and highly suitable for both beginners and seasoned stakers. StakeStone is one of the best on the market with an APY of 3.43% on 336,710 ETH staked – meaning the fetching maximum gives returns to those investors who want to earn Ethereum.

Users can staked ETH, trade, spend the staked ETH, or use them as collateral without quitting staking. Most staking worlds are offering users unprecedented flexibility, a blend of liquidity and earning potential.

The clarity of StakeStone’s reward system is impressive. The “One Staking, Three Returns” scheme demonstrates how users collaborate with the STONE protocols and decentralized ETH staking – for more yield and liquidity. The importance of this transparency is to create trust and encourage participation.

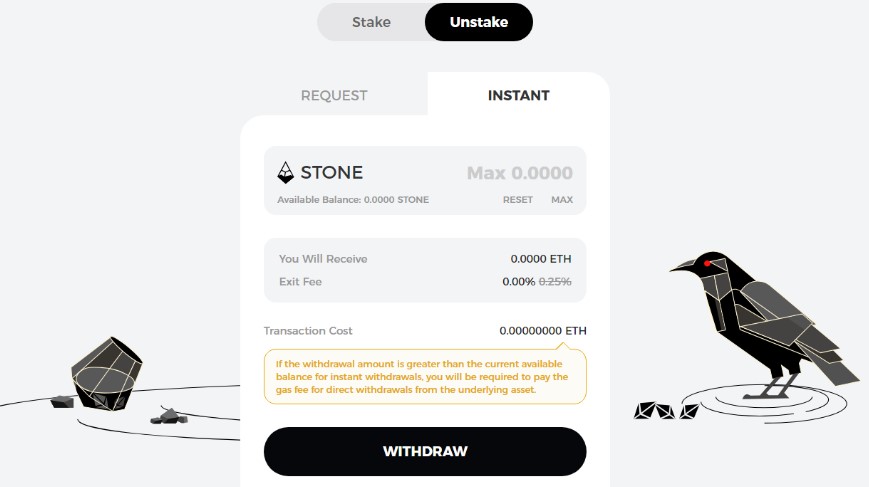

However, users need to understand that immediate withdrawals in this ecosystem require a percentage payment as gas fees for ETH. StakeStone ensures that users will be informed about all the conditions like lock-up periods and higher fees for withdrawal options. Transparency in this commitment allows users to vote and regulate a responsive staking environment. For example, users can follow all the latest news about the project on their official StakeStone Twitter/X account.

Is StakeStone Legit and Safe?

To achieve high-security standards, StakeStone follows strict protocols. The user’s staked ETH is still self-custodial and permissionless — StakeStone does not directly access your assets. This principle of self-custody is all about giving users control by default and reducing the risks of unauthorized access.

Secure3 & Veridise is a professional blockchain security firm that has audited StakeStone. The audits build trust in StakeStone’s security measures by external validation, so users can have transparency and confidence these investments are protected. The protocol’s security is also confirmed by its audits through CertiK and PeckShield. StakeStone’s goal is to launch a secure token to allow active stakers to be rewarded during the token airdrop.

With automatic yield optimization, the platform’s process makes sure the staking yields are competitive without manual intervention. Investor’s portfolio and token allocation are optimized in this decentralized system with consistently high returns. In addition, the LayerZero technology supports seamless transfers of assets as well as prices across various blockchains, which StakeStone also supports through signed partnerships.

StakeStone combines these security measures with third-party audits and advanced technology to be a secure stake and manage digital asset platform.

StakeStone Tokenomics and Pre-Sale

Thanks to DeFi technologies, StakeStone uses the innovative omnichain liquidity staking protocol. It helps to enhance the user’s on-chain experience. StakeStone overcomes liquidity fragmentation and simplifies the process of acquiring on-chain assets while allowing web3 developers to create many yield opportunities.

Key Components of StakeStone Ecosystem:

- $STONE LRT. This Ethereum liquid rebase token allows you to earn yield from staking ETH while keeping your invested funds fully under your control. Unlike conventional LRT protocols, StakeStone plans to merge different blockchain networks to reduce the loss of opportunity cost and liquidity fragmentation for Ethereum re-stakers;

- $SBTC and $STONEBTC. These tokens resolve Bitcoin’s liquidity fragmentation and provide a lack of utility. $SBTC is a tokenized Bitcoin with unprecedented omnichain liquidity. While $STONEBTC backs the yield-bearing liquid BTC-based on emerging yield sources like Bitcoin staking networks;

- $STONE assets will be deposited into pools where vault tokens are going to be issued for users to earn the yield returns within DeFi blockchains and participate in giveaway campaigns like token airdrop;

- Stone.Pay (Coming Soon). Users can pay transaction fees on many chains with $STONE tokens increasing the on-chain user experience;

StakeStone Tokenomics:

StakeStone’s tokenomics intends to reward staking and increase its long-term value. While specific numbers are kept partially in the “dark”, some investors and insiders claim that the $STONE token’s total supply has already reached about 100 million (this supply can change as the protocol grows). About 20-25 million of $STONE were circulating as of February 2025, based on staking and liquidity pool activity.

Allocation of all tokens after the launch – stated on the official website of StakeStone.IO:

- 5-7 % for the APY as yields reserved for 40% of Stake rewards;

- 25% for Liquidity Provision. These tokens will be locked in cross-chain pools to prevent dry pools on the exchanges;

- 20% for Development & Treasury. Reserved tokens for the protocol upgrades and security audits;

- 10% for Team and Advisors. Locked/vesting period of multi-years;

- 5% for Airdrops and Promotional Campaigns;

$STONE’s emission is dynamic. The token will be emitted when staking demand is changed, rewards will adjust, according to the network’s participation.

Transaction fees are partially burned over time, leading to a reduction in supply and price stability. More about the StakeStone coin’s tokenomics you can find out from this video.

StakeStone Pre-Sale Details

To date, StakeStone has conducted private sales for $22 million. No exact token distribution and pricing are revealed, however, the funds will be used to develop and expand the protocol. As part of the project’s current campaign, users’ investments are supported through staked ETH on L2s while getting points.

Because of this approach, while StakeStone’s founders have decided to remain anonymous, they have chosen to make their protocols public and accessible to anyone who wants to invest. The team claims to be blockchain development experts with some experience around top-tier protocols in DeFi yield optimization.

Crypto space has seen anonymity as a common thing. Popular memecoins like Dogecoin or Hoppy coin also do not have public figures as claimed by founders. Despite being KYC/ID-less and lacking public identities, StakeStone’s $10 million raised from BingX and other VCs gives it an air of credibility.

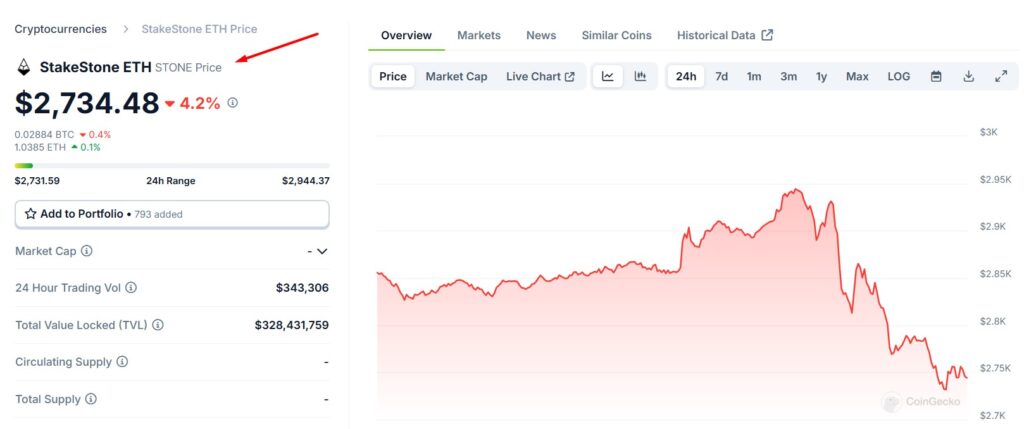

StakeStone Price Predictions 2025-2030

A full market launch of $STONE token of StakeStone is planned for Q2 2025, and as of February 20, 2025, there is no public trading history against the other platform’s tokens besides $STONE. Right $STONE token price depends on the ETH price. After the launch in 2025, the token will have its own value based on the L2 blockchain and ETH value. The following forecasts are based on public suggestions and our own analytics. It MAY happen but the forecasts could be also wrong. Take them with a grain of salt.

StakeStone Price Prediction for 2025:

- Optimistic – $5-$7. BAW assumes that the L2 works out successfully, Binance lists the token, and Ethereum takes off for $5,000–$6,000. In a bull market a 5x to 10x gain from seed prices is likely;

- Conservative – $2-$3. This is a signal of moderate adoption and competition from stETH. It still represents a 2x-4x return;

- Bull Case – $10+. If StakeStone is able to grab 0.5% of the global staking liquidity tied to a $500 million market cap;

StakeStone Price Prediction for 2026-2029:

- Optimistic – $8-$12. The cross-chain DeFi is growing and so are yields;

- Conservative – $4-$6. It assumes a post-2025 market correction;

StakeStone Price Prediction for 2030:

- Optimistic – $20-$30. However, StakeStone forecasts that $STONE will become a DeFi staple like Lido’s $20 billion TVL. $STONE may reach a $2 billion+ market cap;

- Conservative – $10-$15. StakeStone will continue to grow;

All these forecasts about the StakeStone token price depend on the trends resulting in Bitcoin’s value reaching $200,000 and Ethereum’s staking surge. StakeStone offers 5-7% APY and a “burning” mechanism to support the price growth but also comes with an unlisted status that can’t give any precise prediction.

The tokenomics of its rewards and deflation have its priority, but transparency is an issue. With $10 million raised, the anonymous team’s optimistic hopes for cautious optimism and the price predictions of $5 to $30 in 2030 are both bullish and volatile.

If StakeStone manages to capture a good share of the staking markets, which is estimated to be over $100B, prospects are bright. Nevertheless, there remain risks such as competition, execution, and regulatory hurdles.

At the time of $STONE investment, investors are given a glimpse into possibly a great project, but patience is required. The protocol will be successful if it delivers a robust, trusted protocol in a competitive field.

Potential StakeStone Risks for Investors

Disclaimer! This post is not about giving you any financial advice or promoting certain crypto projects. You need to make your own decisions about investing or skipping into the StakeStone project. Do your research before investing real money and never trust anyone who offers you to invest without the deep research of the project.

Potential risk factors for StakeStone:

- The team wants to have a $10 million share from the common pool. It looks suspiciously like a rug pull according to some bloggers and veteran crypto investors;

- It is difficult to develop a secure and scalable L2 staking solution. This could erode investor confidence if some delays or bugs happen in the future;

- Lido, Rocket Pool, Ankr have established their positions as LST (liquid staking token) market giants. To attract new users, StakeStone must distinguish obvious benefits from other competitors;

- The drop in the global crypto market could cripple $STONE’s value due to staking’s stability. But if the market is stable and grows steadily, then $STONE will continue to grow as well;

- The use of cross-chain staking may attract regulatory issues despite a pro-crypto ambiance. Such developments could influence StakeStone’s operations and growth;

Though there is a high potential upside for early investors in $STONE they should also consider these risks. It is important to diversify to reduce any possible losses. If StakeStone can successfully scale and integrate with the major DeFi protocols, it will potentially be capable of capturing a significant part of the staking market and could reach the top of 50 tokens.

How to Buy StakeStone – $STONE?

At the time of writing in February 2025, $STONE is available for investing only during the pre-sale stage. The public listing and the token’s launch will be in Q2 2025.

This is how you should buy StakeStone during the pre-sale stage:

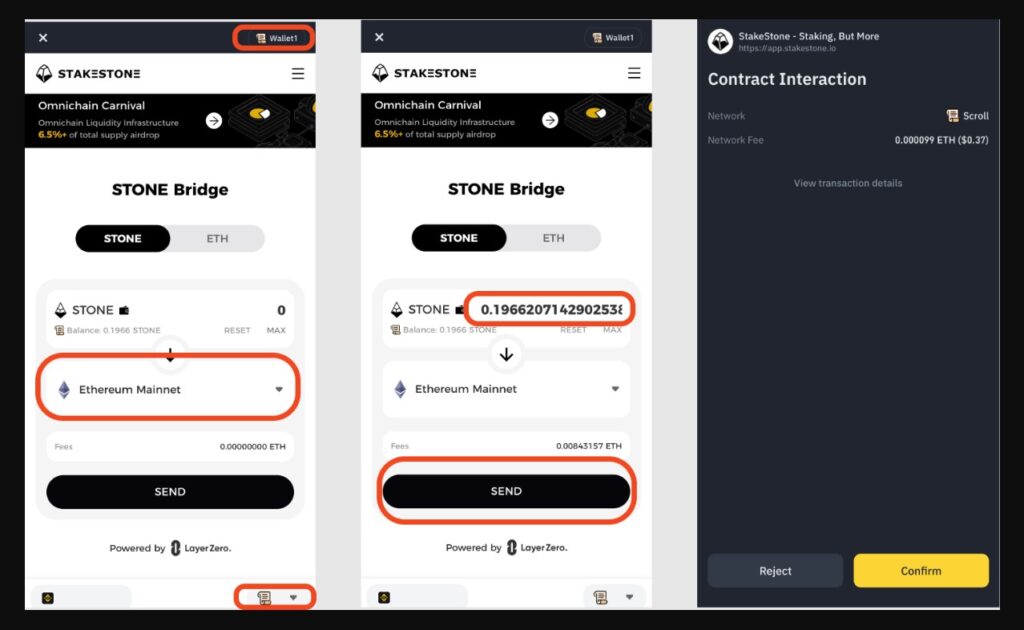

- Visit the Official Website. By registering on stakestone.io, you can access the presale stage of $STONE;

- Connect Your Wallet. You need to have a compatible wallet like MetaMask or Trust Wallet to go on. Make sure the wallet has the support to store/trade ETH or USDT;

- Purchase $STONE. Buy $STONE with the available seed price ranging from $0.50 to $1.00, according to the pre-sale regulations;

- Your Tokens Will Be Locked Up. Tokens purchased right during the pre-sale are locked until the Token Generation Event (TGE) scheduled for Q2 2025;

After the launch, you will be able to buy $STONE through decentralized exchange services directly.

Important notice! Keep in mind that you need to pay gas fees for each transaction within StakeStone’s ecosystem – this fee may vary from $5 to $20 depending on the use of the network. Always check the contract addresses via official StakeStone channels to prevent being scammed. Before making any transaction, make sure your wallet is configured and secured.

StakeStone Collaborations and Partners

To financially support the expansion of their ecosystem and give users more opportunities in the DeFi technologies, StakeStone has set up several strategic partnerships:

- StakeStone partnered with Movement Labs to integrate the $STONE, $SBTC, and $STONEBTC assets into Movement’s ecosystem. With this collaboration, users can unlock liquidity without compromising yield and be a part of advanced DeFi strategies across multiple protocols on the Movement ecosystem including Joule Finance and Stable Jack;

- StakeStone partnered with Plume Network to allow liquid staking while combined with Real World Asset Finance (RWAfi). Thanks to this integration, users can stake ETH or BTC through liquid assets with StakeStone. They can tokenize real-world assets in Plume’s platform for their capital efficiency, as well as to invest in diverse investment opportunities;

- StakeStone included the liquidity percentage for $STONE and $STONEBTC through the partnership with Kodiak. Users can provide liquidity to the Kodiak Islands and get trading fees along with some incentives. The partnership also provides the users with an opportunity to use Kodiak Island Liquidity Provider (LP) tokens as a collateral asset for other DeFi platforms;

- The partnership between StakeStone and Berachain will involve deploying a $STONE token on Berachain’s testnet. StakeStone’s liquidity assets can be used for participation in the Berachain ecosystem and earn rewards for users;

- StakeStone has partnered with Cobo, the world’s leader in digital asset custody technology. They integrate Cobo’s Multi-Party Computation (MPC) technology into the StakeStone ecosystem. Thanks to this collaboration, deposits, and redemptions become more secure for the assets with a new gold standard of the user’s trust and accessibility for simple Ethereum staking and re-staking processes;

StakeStone also works with many prominent projects like Hook Protocol, Merlin Chain, and Polyhedra. By expanding these partnerships, StakeStone will be able to reach out to more people and enable them to participate in more DeFi activities and blockchain networks.

Frequently Asked Questions

How much is the StakeStone governance token $STONE?

The StakeStone token price directly depends on the ETH price. Make sure to follow such chart-tracking websites as CoinMarketCap to check the daily changes in the price.

What is StakeStone airdrop?

StakeStone airdrop is a way to invite stakers to deposit $ETH in Merlin Layer2 Seal, BSquared Network Buzz, or any other staking platforms. In such a way, the airdrop’s participants can start accumulating the StakeStone points. The ecosystem grows in such a way as to provide better rewards for the investors.

Which are the main partners of StakeStone?

Binance Labs (read about this recent collaboration on Reddit), Polychain Capital, OKX Ventures, Berachain, Movement Labs, Monad, Plume Network, Corn, Pendle, Hook Protocol, StakeStone Scroll, Merlin Chain and Polyhedra are the main partners of the StakeStone platform.

Conclusion

We hope that this review of StakeStone’s new staking platform was useful for you. Make sure to bookmark our website if you are interested in such reviews with our insights and analytics. The Senay team works to deliver the news about the rising and trustworthy projects in the crypto world.