The XRP Lawsuit Update – Key Points

The Ripple vs. SEC lawsuit remains one of the hottest topics inside the crypto community since it started in December 2020 and is still ongoing as of February 2025. The Senay Team will walk you through the main aspects of this infamous XRP lawsuit so you can understand the key points and make a weighty decision about whether to invest in XRP or wait until the lawsuit’s end. Just like always, we encourage you to act smart and not let anyone impact your decision about potential investments. Think of this warning as a disclaimer for the whole post as well.

XRP Lawsuit Background – A Clash of Titans

How Did It Start?

The United States Securities and Exchange Commission (SEC) launched an unexpected attack against Ripple Labs in the late months of 2020. The SEC claimed Ripple conducted an illegal unregistered sale of XRP tokens that lacked the proper registration. The SEC declared that Ripple gained more than $1.3 billion through token sales activities. The cryptocurrency field experienced an enormous transition when regulators began to question if XRP belonged under the definition of a “security asset” instead of remaining a currency.

Ripple didn’t back down. XRP functions as a payment instrument and cores closely with Bitcoin and Ethereum since Ripple advocates that it represents a utility token. The purpose of Ripple’s product was to serve functionality rather than generate investment profits.

Early Stages

Ripple made their first significant business move in January 2021. The company showed intense determination by declaring that XRP acts as a digital currency instead of a security asset. Ripple submitted a court request to terminate the case in March of that year while continuing to argue that XRP does not constitute a security asset.

Meanwhile, the market reacted swiftly. When Ripple announced its XRP lawsuit against the SEC, the price of XRP experienced a devastating drop exceeding 50%. Exchanges that traded XRP removed it from all trading lists, which prompted holders to panic. Ripple maintained its activities to establish financial partnerships with institutions as the market experienced turmoil – keeping community members confident during this unpredictable period.

Discovery Phase

During the discovery phase of the case, the proceedings started to become more intriguing. From 2021 up to early 2023, each party provided documents and proofs. The discovery phase revealed the facts through Magistrate Judge Sarah Netburn’s determination to release the “Hinman emails” of the SEC internal communications.

As for the early testimony, William Hinman who worked at the SEC declared that Ethereum did not qualify as a secure asset since its initial release. Internal SEC communications demonstrated inconsistency in the agency’s classification system for distinct cryptocurrencies but couldn’t prove the security issues related to XRP as a crypto asset in particular.

Ripple used this information to support its position that the SEC failed to deliver legal rules about digital asset classification. With such regulatory uncertainties, could Ripple Company and other firms expect to find their way through the complex web of rules and regulations? You will find out by following the XRP lawsuit update today.

July 2023 Ruling

The July 2023 judicial ruling by Judge Analisa Torres gave Ripple Labs some of the outcomes they hoped for. XRP sales were carried out on open marketplaces because the judge declared they were not violations of security policies.

Judge Torres established that XRP sales made to institutional investors broke security regulations despite her ruling that open-market sales of XRP had legal validity.

The moderate legal conclusion showed the intricacy of governing digital assets within the regulatory framework. Retail traders experienced a temporary feeling of contentment, but Ripple faced ongoing concerns regarding its previous conduct and future regulatory compliance.

Moving Toward the Closure

Judge Torres established new deadlines for the discovery of remedies and following briefing during the late November dates of 2023. The process included:

- Completion of remedies-related discovery by February 12, 2024 – check how Reddit users reacted to this decision;

- Filing briefs by March 13, 2024;

- Opposition filings by April 12, 2024;

- Plaintiff replies by April 29, 2024;

As of February 15, 2025, the XRP lawsuit still has active status at the Court of Appeals for the Second Circuit. The SEC filed its initial appeal brief before the Court of Appeals for the Second Circuit on January 15, 2025, after the district court declared XRP to be non-security when Forex traded. The company plans to file its submission to the court on April 16, 2025.

Check the chronological order of the SEC vs Ripple lawsuit, its details and follow the XRP lawsuit update today live.

XRP Lawsuit – Defense and Arguments

The XRP lawsuit has provided an intense experience for all members of the crypto community. The SEC’s lawsuit against Ripple Labs from December 2020 marks a crucial point both for US cryptocurrency regulation and for the whole crypto industry.

Ripple faced legal action from the SEC because it allegedly sold XRP tokens as unsecured investments without registering these transactions as security operations for the federal authorities. The SEC claims Ripple obtained $1.3 billion from these unregistered transactions. Ripple defends XRP as a digital currency rather than a security which requires different forms of regulatory control.

SEC’s Case Against Ripple

The SEC bases its legal position against Ripple by defining XRP sales as investment contracts that have to follow the legal standards of the US legal system. Multiple crackdowns on digital assets have led to this particular case – there were many similar precedents.

Previously, the SEC ordered Telegram to shut down its TON project following its classification of GRAM as an unregistered asset with unstable security protocols.

For example, Block.one received a $24 million fine from the authorities for completing EOS token transactions. The SEC demonstrates through these cases its dedication to executing security legislation within the cryptocurrency domain.

Ripple’s Defense

Ripple acts defensively against the SEC’s allegations. XRP works as a utility token, according to Ripple, because it enables users to execute fast and inexpensive cross-border payments. Ripple uses this proof from Bitcoin and Ethereum operations as it supports that the SEC has not designated them as secure assets.

Ripple maintains that XRP operates autonomously from corporate action which, according to them, makes it function similarly to a currency rather than a security asset. The defense presented by Ripple received support from recent judicial decisions that established XRP transactions to retail customers do not fall under security regulations.

Impact of XRP Lawsuit on the Crypto Community

The ongoing lawsuit generated a major effect on cryptocurrency market value. When Ripple announced its XRP lawsuit against the SEC dropped by more than 50% in value. Binance, together with Coinbase, removed XRP from their platforms to comply with regulatory standards. Ripple faced adverse effects together with additional market uncertainties throughout the crypto market as a direct result of this move. Binance, together with Coinbase,

Supporters of Ripple maintained confidence in the market potential of XRP and the company’s partner projects. XRP’s price has demonstrated a recovery trend currently but remains below its peak value that was in 2018.

New leadership at Ripple is causing the weight of the ongoing SEC case against the company to decrease.

New progress indicates a positive change regarding Ripple’s situation. The SEC made a crucial gesture toward Grayscale by officially reviewing the XRP/ETF application. The SEC has made an opposite decision about Solana ETF applications since their initial rejection.

Analysts predict that the incoming SEC leadership under interim chair Mark Uyeda demonstrates greater favor towards cryptocurrencies. Uyeda has gained recognition for his Crypto Task Force moves that indicate a positive approach to establishing crypto regulations, including Ripple.

What Do the Experts Expect in the Next Few Months?

Ripple plans to file its response brief on April 16, 2025, to address SEC arguments while questioning institutional sales.

The appeal process normally takes several months, but it could extend for about 1 year whenever significant regulatory changes appear.

Legal proceedings continue while crypto investors occasionally imagine possible outcomes of settlements within the case. Professionals have to prove these claims officially.

This case stands to create major industry-wide effects on the entire cryptocurrency sector. The case will establish the basic legal framework that defines how to categorize other virtual currencies or digital assets between securities and currencies. Regulatory definitions that provide market stability would lead to institutional adoption and innovation of the market.

It is also worth checking the long stream from a crypto investor about the latest XRP news about the lawsuit on YouTube.

When Is the XRP Lawsuit Over?

The ongoing legal lawsuit over XRP has reached its highest point of importance although the case continues. Judge Torres issued a final judgment through his ruling that stated that XRP represents a security asset during institutional sales while maintaining its non-security classification when transacted between exchanges in August 2024.

Court officials rejected the SEC’s demand for Ripple to return $125 million because the company received this fine for its institutional sales violations. The disputing parties have started their appeals after Judge Torres issued her final ruling that is currently undergoing the appellate proceeding.

Major Difficulties Preventing the XRP Lawsuit End Date

Complexities in cryptocurrency regulations remain the main hurdle to preventing the settlement of the XRP lawsuit. XRP is subject to divergent perspectives about its security status between Ripple and the SEC. XRP sales to institutions represent secure transactions, according to the SEC, but Ripple asserts that XRP works as a utility token for international payment processing.

The main reason Ripple faced an SEC investigation is because the SEC designated XRP as an unregistered security asset. The SEC maintained that Ripple made illegal XRP sales to its institutional investors and clients under federal securities regulations. The classification of Ripple’s XRP as a security asset follows the Howey test protocol for investment security determination. The SEC considers institutional transactions of XRP to satisfy the security status, but Ripple defends XRP as a utility token for payment network operations.

Ripple must now determine whether it should untether from XRP operations because this move could help reduce the upcoming legal consequences. Ripple’s business operations may split away from XRP even though they remain interdependent as of February 2025. XRP keeps its operational independence from Ripple no matter how well or poorly its legal battles happen, although its future value and long-term viability remain uncertain.

The crypto community already reacted to the XRP lawsuit by posting numerous price predictions.

XRP Price Prediction After Lawsuit

Ripple and XRP’s possible legal victory may greatly influence the token’s upcoming trends, but there exist considerations to keep in mind if you are a crypto investor. Solving out the XRP lawsuit with the SEC may give Ripple more freedom with a higher demand for XRP as well as its popularity as an investment asset.

This is key for making the durable value trend for XRP. But there is one point we need to remember: banks can use the recently launched Ripple Payments network without needing XRP. They can choose fiat currencies instead. This flexibility could be the reason for XRP still being traded under the value that was in 2018 when the lawsuit was over. And the transaction volumes on the Ripple network are constantly increasing.

The XRP price could be more impacted by people guessing about its price rather than the actual market trends or the outcome of the XRP lawsuit. Such factors may affect the price prediction of what will happen in the days to come difficult. In the past, the XRP value dropped by over 90% after it reached up to $3.40 in 2018. Even though the less strict regulations are good for Ripple and XRP, they do not ensure continued profit increases for those users who invest in XRP because its value has dropped.

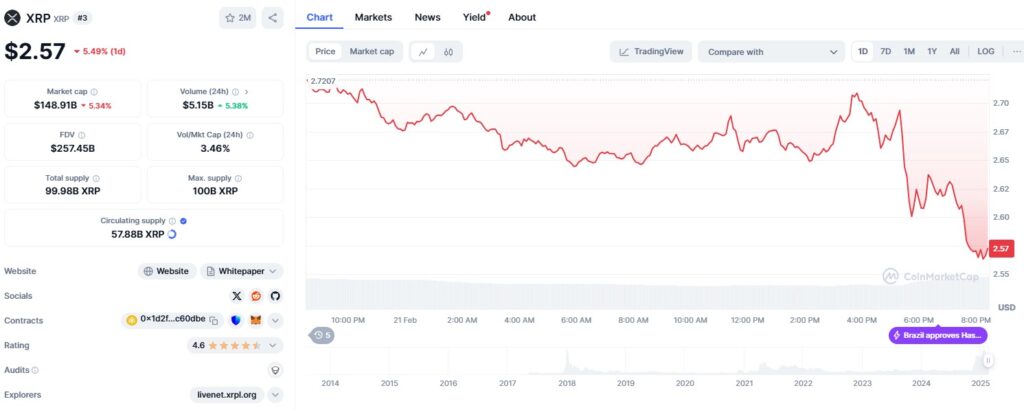

On February 12, 2025, the XRP currency rose up by 2.52%, finishing at a price point of $ 2.47, and this was consistent with an overall market increase of around 2.62%. Yet still, XRP is not matching its peak value, which was $3.39 in 2018, as the situation about SEC’s appeal continues to be unclear even now.

Key XRP Price Scenarios:

- Positive Situation. If the SEC takes back its appeal, XRP might surge beyond its historical top of $3.55. A “greenlight” for an XRP-spot ETF can push the price near to $5, powered by institutional interest;

- Bearish Scenario. If the SEC goes ahead with their appeal and does not approve applications for XRP-spot ETF (we recommend you check our Spot BTC ETF – FBTC stocks review), the token may fall under $1.50;

Factors That May Influence the XRP’s Future:

- Environment of Regulation. SEC has recognized the Grayscale’s XRP ETF filing. Also, possible rule changes with new leaders could increase confidence in investors;

- Mood of the Market and Big Fish Actions. Large transactions done by whales, like one recent transfer of $430 million, suggest clever actions from major holders. Perhaps they are setting a plan for a breakout;

- Ripple’s Partnerships. The increasing network of partnerships of Ripple, involving collaborations with prominent financial institutions, may boost the adoption and worth of XRP tokens;

Although the SEC vs Ripple/XRP lawsuit resolution and possible ETF approval may give a substantial boost to XRP, its value is still highly speculative. Investors must stay vigilant and keep a close watch on regulatory progressions.

Frequently Asked Questions

When will the XRP lawsuit end?

We do not know when the XRP lawsuit will finish. As of February 2025, Ripple company has asked for a short deadline of April 16, 2025, and the SEC had submitted their appeal brief before January 15, 2025. The case could continue until the end of 2025 or even go as far as the year-end of 2026 based on how appeals and court decisions proceed.

How will the XRP lawsuit end?

From a theoretical point of view, the XRP lawsuit has multiple potential conclusion points. Ripple’s potential agreement with the SEC to resolve the lawsuit could happen because of the influence from Mark Uyeda who now leads the SEC as the acting chairman. A final verdict from the appeals court will take numerous months to arrive – the whole process may require over 12 months.

How high will XRP go after the lawsuit?

To try and guess what XRP’s worth will be after the court case is risky. If the judgment goes well, it might make investors more confident and want to buy more, which could push up the XRP price. On the other hand, if things don’t go in favor of XRP, it may result in less interest from crypto investors and cause a reduced value. Market dynamics will significantly influence the outcome.

Conclusion

The Senay team will keep on following XRP lawsuit news to update you on this matter. You should bookmark the website because we post interesting facts from the crypto community, and give insights and reviews about the latest coins.