XPR Price and the Quiet Revolution of Proton Network

Honestly, you know what’s exhausting? All the hype. Every other day, some “revolutionary” project pops up, promising the moon but delivering a teaspoon of dust. That’s why I started paying attention to things that actually work-and that’s what brought me to Proton, or the XPR Network. Let’s take a closer look at the XPR price.

Look, the whole crypto world is built on promises of seamless transactions and identity security, right? But try sending some tokens to a buddy. You’re wrestling with a 40-character wallet address, sweating over gas fees, and then waiting an eternity for the transaction to confirm. It’s a total headache. The thing is, Proton (XPR) set out to fix that mess, and they’ve done a pretty good job so far.

What makes XPR different, really? It’s simple, but sometimes the simple stuff is the hardest to pull off. They wanted a blockchain that felt like using a modern app-fast, free for basic stuff, and ridiculously easy. Think about it: they gave us human-readable account names. Instead of 0xAbC...123, you send money to @YourFriendName. That’s not just a cool feature; that’s removing a major barrier to mass adoption. XPR price movements aside for a moment, that user experience is priceless.

The Tech Talk: How XPR Is Built for the Real World

For the crypto-heads out there, you’ll appreciate the technical finesse. Proton is a Layer-1 delegated proof-of-stake (DPoS) blockchain. What’s that mean in plain English? It’s fast. Really fast. We’re talking transaction finality in under a couple of seconds, which, in the DeFi world, is practically instantaneous.

And here’s the kicker, the part that actually gets me excited: zero gas fees for basic transfers. You send 100 XPR; your buddy gets 100 XPR. End of story. Compare that to the often insane gas wars we see on Ethereum, and it’s a total breath of fresh air. They manage this by having users stake XPR to get the necessary network resources (CPU and NET), which is just a smarter way to handle resource allocation than making every tiny transfer a cash grab.

They’re also not messing around with regulation. Proton is built with an eye toward compliance, aligning with things like the ISO 20022 standard. This isn’t just bureaucratic fluff; it positions the network to actually integrate with the old-school “TradFi” financial systems. It’s like they built a super-fast race car that can still park nicely in a conventional garage. That subtle nod to institutional readiness is a pretty strong bullish cue if you ask me. It’s something that the big players-the J.P. Morgans of the world-will definitely notice as they start getting serious about blockchain settlements.

XPR’s Core Value Proposition

| Feature | XPR Network (Proton) | Older Chains (e.g., Early Ethereum) | Why It Matters |

| Transaction Fees | Zero for basic transactions | Variable, often high gas fees | Makes micro-transactions and everyday use viable. |

| Wallet Addresses | Human-readable (@Username) |

Long, complex hex strings (0x...) |

Mass adoption ready; eliminates user error. |

| Identity Layer | Built-in KYC/Identity solution (Proton Verified Identity) | Requires third-party solutions or is non-existent | Crucial for regulated DeFi and institutional entry. |

| Transaction Speed | Fast finality (under 2 seconds) | Can take minutes or longer during congestion | Better for payments, exchanges, and high-frequency DApps. |

Digging into the XPR Price Action: Current Vibe Check

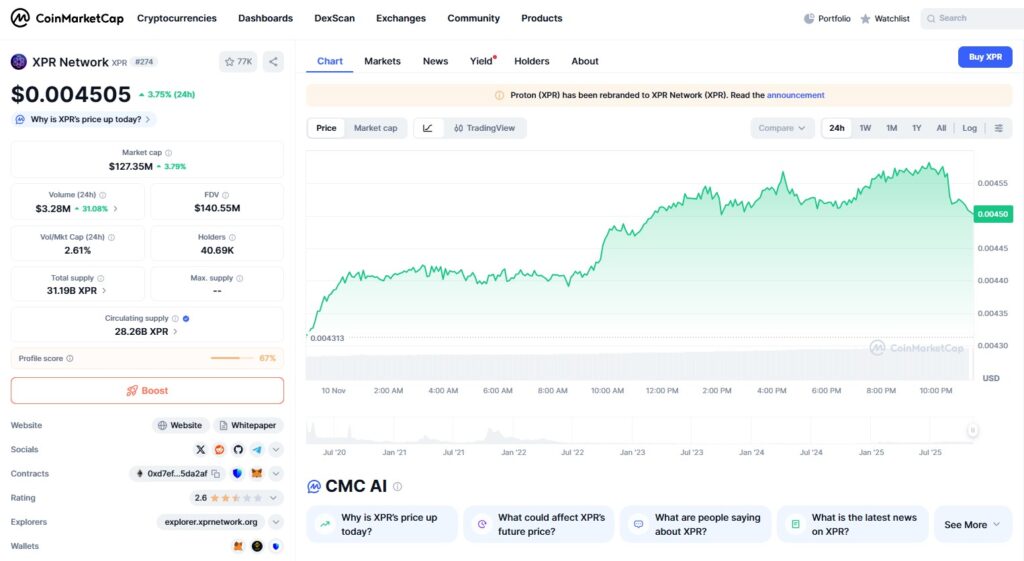

So, let’s talk turkey about the XPR price. I’ve been watching this one for a while, and honestly, it’s a story of an undervalued asset slugging it out in a market full of shiny objects. As of my last check, XPR is trading in that sweet, sweet micro-cap range – it’s sitting at a tiny fraction of a dollar.

Now, here’s where it gets interesting, and you have to put your analyst hat on for a second. The current market cap is low, hovering somewhere around the $120-130 million mark. That’s relatively small potatoes when you look at the total value locked (TVL) in their DeFi ecosystem, which includes things like Proton Swap and Proton Loan. Their TVL is actually creeping up on what some much larger market cap projects are doing. You know what that means? The valuation just hasn’t caught up to the actual utility being built. It’s a classic value-investing setup in crypto, though you gotta be patient, you know?

The overall crypto market sentiment right now is… well, it’s a mixed bag. Bitcoin dominance is still pretty high, and the real “alt season” hasn’t fully kicked off yet. When the big money rotates out of Bitcoin and Ethereum into the smaller caps, tokens like XPR, with real infrastructure, are usually next in line.

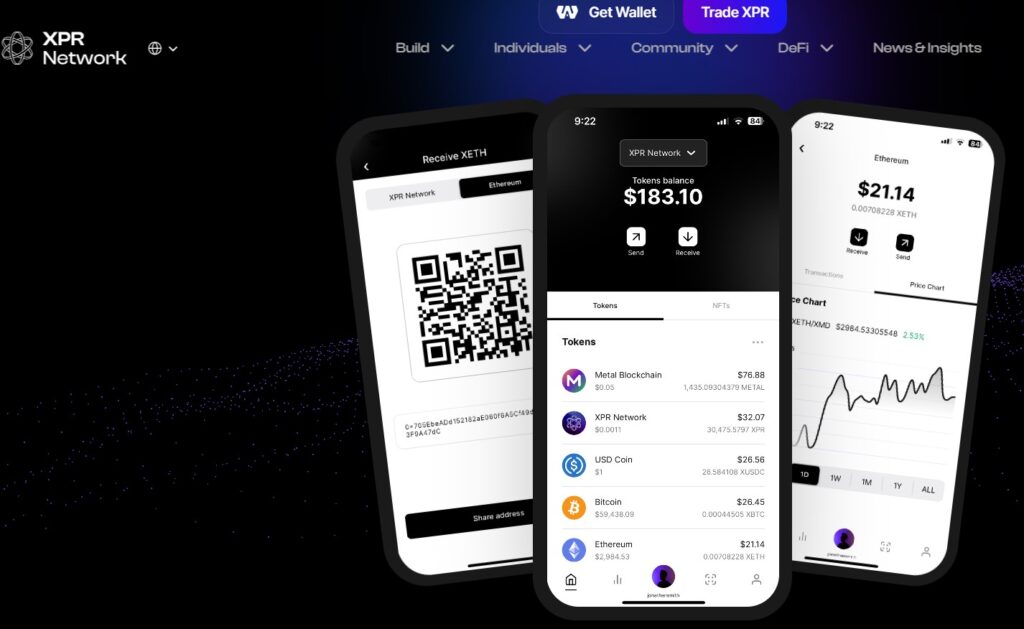

My Personal Staking Experience and the Proton Wallet

I’ve actually used the Proton Wallet, and I can tell you firsthand: it just works. I’m one of those people who lost Bitcoin way back because I forgot an old hard drive password – don’t even ask, it still stings. Security and simplicity are massive for me now. The Proton Wallet is simple, and they even offer staking right in the app.

When you stake your XPR, you’re locking it up to vote for Block Producers (the network validators), and you get rewards for it – we’re talking decent APYs, sometimes in the 6-8% range. It’s not just about earning; it’s about network security, too. You’re becoming a part of the governance. I always like projects where you’re incentivized to HODL and participate, not just flip quickly.

It’s worth noting that they’re also building out features like biometric key recovery (using your face or fingerprint to recover your wallet). That’s a huge deal for self-custody. Losing your seed phrase is the ultimate crypto nightmare, but Proton is trying to make it less terrifying.

How to Get Your Hands on XPR (The Wallet Stuff)

So, you’re thinking about getting some XPR? The process is pretty standard, but XPR has a few extra-friendly ways to onboard folks.

You’ve got a couple of options:

- The Centralized Exchange (CEX) Route: This is the easiest for most people. XPR is listed on a bunch of exchanges. I’d recommend checking major ones like KuCoin or Gate.io, but honestly, a quick search on CoinMarketCap will show you all the available spots. You’ll just set up an account, do the usual KYC (Know Your Customer) thing, deposit some fiat or stablecoins like USDT, and then trade for XPR on the spot market. Easy peasy.

- The DEX and Wallet Route: This is for the folks who like to keep their assets off-exchange.

- First, you’d get the official Proton Wallet (WebAuth).

- You could then buy XPR directly with a credit card or bank transfer inside the wallet using their fiat on-ramp partners. This is often the most direct way.

- Alternatively, you could send a crypto like ETH or USDT to your Proton Wallet and then use Proton Swap-their native decentralized exchange – to swap for XPR. The beauty of their own DEX is that it’s designed to be seamless.

It all boils down to your comfort level. If you’re new to crypto, a CEX is probably your best bet. If you want full control and plan to stake, jump right into the Proton Wallet.

The Comparison Game: XPR vs. The Big Boys (Like XRP)

Let’s address the elephant in the room: the name. Yes, the ticker XPR is incredibly close to XRP (Ripple), and some critics have pointed this out, suggesting it confuses. Is it intentional? Maybe, maybe not. What matters is the tech behind it.

XRP is focused almost entirely on cross-border settlements for banks and financial institutions – it’s the ultimate “banker coin.” The XRP Ledger is certainly fast and efficient, but it’s often seen as less “decentralized” and more focused on the enterprise B2B world.

XPR, on the other hand, is trying to build the entire user-friendly ecosystem. They’re doing identity, payments, DeFi, and NFTs, all on a fast, fee – less chain.

Think of it like this:

- XRP is the professional cargo plane: It moves massive amounts of value efficiently between institutions.

- XPR is the sleek electric car: It’s designed for everyday use, with zero (gas) cost, an easy-to-use interface, and compliance features that make it safe to use for a wide audience.

They’re actually solving slightly different problems. XPR’s lower market cap but high utility-to-market-cap ratio suggests it has more room to run if mainstream adoption catches on. It just hasn’t had its massive, multi-billion-dollar hype cycle yet, which, honestly, is kinda nice for people looking for an entry point.

What’s Next? XPR Price Prediction and a Little Glimmer of Hope

Disclaimer: Let’s be super clear about this. I’m just a crypto enthusiast and investor, not a financial advisor. This is my personal opinion and analysis based on current market data and project utility. Crypto is volatile; you could lose everything, so only bet what you can afford to lose. Do your own research (DYOR)!

I’ve seen a lot of folks throwing out crazy numbers, but let’s keep it real and grounded. Predicting an XPR price is tough because so much depends on the overall market (hello, Bitcoin halving) and its ecosystem adoption.

What I found is that analysts are generally bullish, but cautiously so. The common narrative is that XPR is fundamentally undervalued.

Here’s a breakdown of possible scenarios for XPR price predictions:

| Timeline | Low Estimate (Base Case) | High Estimate (Bull Case) | Reasoning |

| End of 2025 | approx. $0.006 – $0.007$ | approx. $0.008 – $0.012$ | Base assumes slow ecosystem growth and a general market uptrend. High is based on successful A-Chain upgrade and wider CEX listings. |

| End of 2026 | approx. $0.009 – $0.015$ | approx. $0.02 – $0.03$ | Base assumes sustained growth and successful Fiat On-Ramp. High assumes a full-blown alt season rotation and institutional partnerships from ISO 20022 alignment. |

You know what the big catch is? The market has to care. The current technical indicators are a little bearish in the short term, but fundamental upgrades – like the upcoming A-Chain upgrade and the new developer tools – are massive long-term catalysts. If they keep building out that compliant, easy-to-use identity layer, institutional money will eventually flow where the infrastructure is solid. That could be the 10x play everyone is hoping for. I think a move toward the previous all-time high (approx $0.10) is certainly in the cards during a proper, euphoric bull run, but that’s not a 2025 target, you know?

For now, I’m watching the TVL. If the amount of money locked into Proton’s DeFi applications keeps growing, the price has to follow eventually. It’s just a matter of when, not if.

What I’m Watching in the Proton Ecosystem?

If you’re tracking XPR, you can’t just watch the price chart. You have to look at what they’re actually doing:

- Proton Swap: This is their DEX. The speed is fantastic, and the trading pairs are expanding. They need to keep boosting liquidity to really take off, but it’s a solid piece of decentralized infrastructure.

- Proton Market: This is for NFTs. Selling and buying digital art with virtually no fees? That’s a huge competitive edge over, say, the OpenSea/Ethereum marketplace during peak hours. This could be a sneaky growth engine.

- A-Chain Upgrade: This is a big one. It’s their move toward a super-stack, interoperability-focused blockchain. Basically, it’s about making it even easier for other chains and developers to connect with Proton. More connections mean more potential users.

It’s a testament to the core team that they’re not just sitting around. They are continuously shipping updates, which, frankly, is what separates a serious project from a ghost chain.

FAQ

Why is XPR called a “banker coin” sometimes?

It’s mostly because the name is similar to XRP (Ripple), which works with banks, and XPR Network also focuses on compliance standards like ISO 20022, which bridges traditional finance and crypto.

Is XPR staking safe, and what are the returns like?

Yeah, staking XPR is secure because it’s a core part of their DPoS consensus mechanism. You’re locking tokens to vote for validators. Rewards vary, but they’ve historically offered solid APYs – check the Proton Wallet for the current rate, but expect something in the mid-to-high single digits.

Can I lose my XPR to network fees if I transact a lot?

Nah, that’s the whole point! Basic transfers of XPR are free. You only need to stake a little XPR to get the resources for more complex smart contract operations, but you don’t lose the tokens to a gas fee burn.

Is XPR Network actually decentralized, or is it run by a few companies?

It uses Delegated Proof-of-Stake (DPoS), which means XPR holders vote for Block Producers who validate transactions. While not as permissionless as pure Proof-of-Work, it’s a decentralized model driven by community voting, making it pretty fast and efficient.

What is the biggest risk for XPR investors right now?

Honestly, the biggest risk is that its utility and low valuation remain undiscovered by the broader market. Plus, the competition from other Layer-1 chains (like Solana and Avalanche) is fierce. It’s fighting for visibility.

When is the best time to invest in XPR?

Timing the market is impossible, but generally, investors look for points where utility is high and price is low. The token’s lower volume and price range right now might signal a good accumulation zone for those who believe in the project’s long-term vision and compliance angle.

Where can I store my XPR securely?

The absolute best spot is the official Proton Wallet (WebAuth). It’s designed specifically for the network, makes staking easy, and gives you a human-readable account name.

Conclusion

Here’s what it all comes down to: XPR Network is one of those low-key projects that’s just getting the fundamentals right. They’ve built a fast, free-to-use, human-friendly blockchain with one eye on compliance and the other on making life easier for the average user. That blend of technical precision and consumer-facing design is what separates the long-term players from the pump-and-dump noise.

The XPR price hasn’t exploded yet, and its market cap is still small. But that just means there’s a serious opportunity for growth if their ecosystem development continues and the rest of the crypto world catches on to the fact that you can finally send money with zero gas fees and a simple name. That’s a powerful narrative, you know?

It’s not a lottery ticket; it’s a bet on infrastructure. And honestly, I like those odds better than a meme coin any day of the week.

Final Thought and Disclaimer: I’ve done my research, and I’m enthusiastic about this project, but remember: this is my personal opinion as an investor and crypto analyst. I am not offering financial advice. The crypto market is incredibly risky, and prices can go up as easily as they go to zero. Seriously, please do your own homework before investing a single dime.